Life Insurance in and around Mount Juliet

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Mount Juliet

- Lebanon

- Gladeville

- Hermitage

- Old Hickory

- Nashville

- Hartsville

- Gallatin

- Hendersonville

- Murfreesboro

- Wilson County

- Smith County

- Davidson County

- Rutherford County

- Carthage

- Gordonsville

- Watertown

Check Out Life Insurance Options With State Farm

People decide to get life insurance for various reasons, but the purpose is almost always the same: to ensure the financial future for your loved ones after you perish.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Life Insurance You Can Trust

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select should align with your current and future needs. Then you can consider the cost of a policy, which depends on the age you are now and your physical health. Other factors that may be considered include gender and occupation. State Farm Agent Jeff Gannon can walk you through all these options and can help you determine how much coverage is right for you.

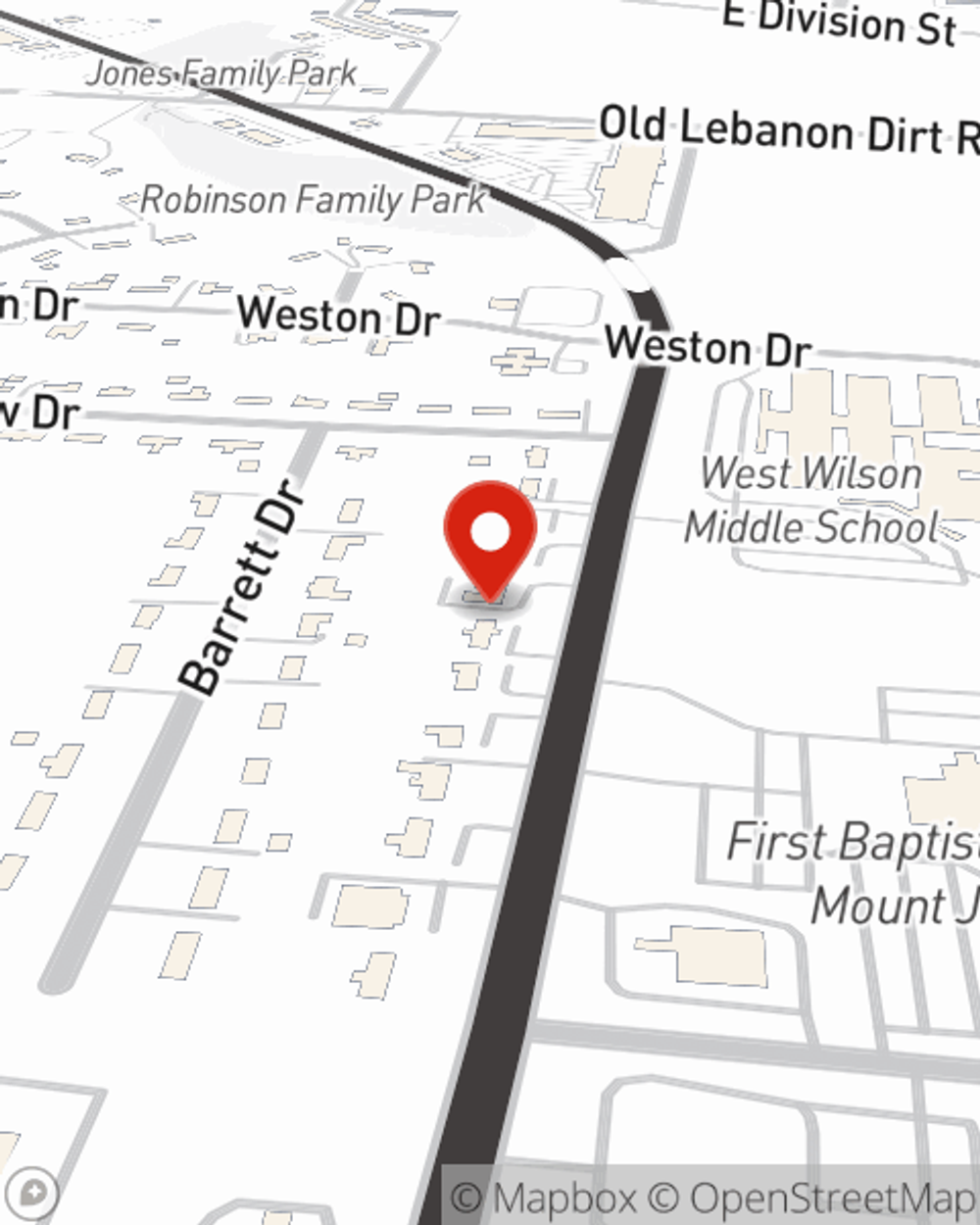

Get in touch with State Farm Agent Jeff Gannon today to find out how the leading provider of life insurance can care for those you love most here in Mount Juliet, TN.

Have More Questions About Life Insurance?

Call Jeff at (615) 773-9000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Jeff Gannon

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.