Homeowners Insurance in and around Mount Juliet

Mount Juliet, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Mount Juliet

- Lebanon

- Gladeville

- Hermitage

- Old Hickory

- Nashville

- Hartsville

- Gallatin

- Hendersonville

- Murfreesboro

- Wilson County

- Smith County

- Davidson County

- Rutherford County

- Carthage

- Gordonsville

- Watertown

With State Farm's Insurance, You Are Home

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of blizzard or fire, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they hurt themselves on your property, the right homeowners insurance may be able to cover the cost.

Mount Juliet, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Open The Door To The Right Homeowners Insurance For You

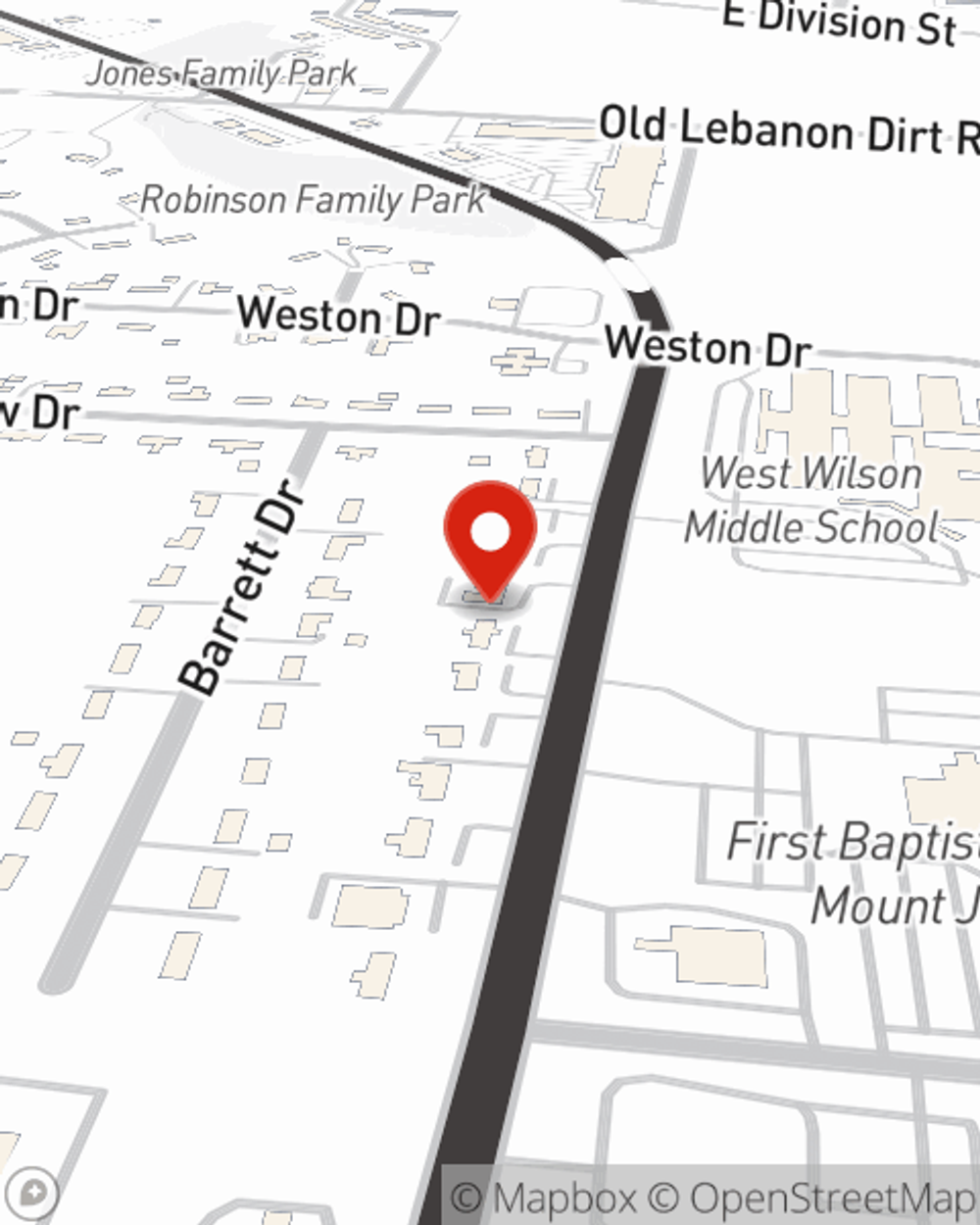

That’s why your friends and neighbors in Mount Juliet turn to State Farm Agent Jeff Gannon. Jeff Gannon can help clarify your liabilities and help you find a policy that fits your needs.

There's nothing better than a clean house and coverage with State Farm that is dependable and commited. Make sure your belongings are covered by contacting Jeff Gannon today!

Have More Questions About Homeowners Insurance?

Call Jeff at (615) 773-9000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Jeff Gannon

State Farm® Insurance AgentSimple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.